A Matter of When, Not If?

If or when? That is the question that some people ask.

If you have followed our last 17 articles on this subject, you may have arrived at the same conclusion I have; natural gas is poised to increase in share as a motor fuel in North America, and perhaps other parts of the world. But I don’t think that natural gas will replace diesel.

Using natural gas is more complex than using the current diesel networks. The more developed the country, the more likely natural gas is to become available as an alternative motor fuel. Where there is an infrastructure of wells, transmission pipelines, and a reliable distribution network, natural gas will gain share. If the supply is plentiful and cheap compared to diesel, the conversion process will move faster.

However, the growth will be more difficult in developing countries that lack the gas supply and the distribution infrastructure. I don’t think conversion is stalled only in developing countries. Consider Japan, a country that imports oil, gasoline, and natural gas. I doubt that natural gas will become a motor fuel in Japan. However, Europe, Australia, China, and parts of the Arabian Peninsula are building out much like the US.

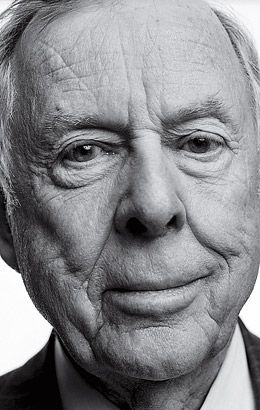

Here in the US, we are leading the wave of conversion. It took Texas energy pioneer George Mitchell over 20 years to figure out how to extract gas trapped in the Barnett Shale that surrounds Fort Worth. Visionary gas drillers like former Chesapeake energy CEO Aubrey McClendon took hold of the idea and built the production. Investors, like T. Boone Pickens (shown right), with his Pickens Plan, started to raise awareness of the gas supply, and advocated using natural gas as a motor fuel. As other investors put money into building distribution infrastructure, engine development, and fuel conversion systems, the rest of the supply chain builds out, and demand increases.

Here in the US, we are leading the wave of conversion. It took Texas energy pioneer George Mitchell over 20 years to figure out how to extract gas trapped in the Barnett Shale that surrounds Fort Worth. Visionary gas drillers like former Chesapeake energy CEO Aubrey McClendon took hold of the idea and built the production. Investors, like T. Boone Pickens (shown right), with his Pickens Plan, started to raise awareness of the gas supply, and advocated using natural gas as a motor fuel. As other investors put money into building distribution infrastructure, engine development, and fuel conversion systems, the rest of the supply chain builds out, and demand increases.

A project as ambitious as changing the US motor fuel market to accommodate a new alternative to diesel takes deep and broad investment. There must be investment not only by the likes of T. Boone Pickens, but also the companies that will be needed to make the engines, the tanks, the infrastructure, and the investment in the vehicles. Investors look for a return on their investment. Most are not gamblers, so they want to feel confident that there really will be a return on the money they invest. As long as the price of crude oil remains above $100 per barrel, there is sufficient return for the model to work. Further innovation that lowers the cost of infrastructure or the efficiency of the vehicles only improves the velocity of the return.

I believe that natural gas will become a significant part of the motor fuel blend here in the US. Here’s why:

|

Country / Region |

Proven Natural Gas Reserves (m3) |

|

Total Globe |

187,300,000,000,000 |

|

Russia |

48,600,000,000,000 |

|

Iran |

33,600,000,000,000 |

|

Qatar |

25,100,000,000,000 |

|

Turkmenistan |

17,500,000,000,000 |

|

United States |

9,460,000,000,000 |

|

Saudi Arabia |

8,200,000,000,000 |

-

Supply: There is a massive supply of energy in the form of natural gas locked in the shale under the US. Right now, the US has over 9,460,000 000,000 cubic meters of proven natural gas reserves, according to the December 2013 EIA projections. If it were just used for motor fuel in trucks, the current proven supply would power a truck over 329 trillion miles. If you figure that Class 8 trucks pound out about 100 billion miles per year, the proven gas reserves could provide over 3,000 years of motive power. Looking at the global supply of over 187 trillion cubic meters, the world’s proven supply of gas is 20 times the US proven supply. With that much supply, the commodity price per BTU of energy of natural gas will remain much lower than oil.

-

Distribution Network: Over the past 75 years, the natural gas transmission pipeline network has spread to cover the entire US. While this network was initially designed to move gas from the fields in the Gulf Coast states, pipeline operators are adding transmission connections to tie in new fields located in Pennsylvania and West Virginia. The network exists for moving natural gas from production to consumption, and it continues to expand, despite protests from environmental activists and NIMBY organizations.

-

Fueling Stations: While soft demand slowed the growth of the LNG fuel station network in 2013, there is enough momentum in place to support the early growth of the over-the-road market. The CNG and LNG fueling networks currently look for demand before making the commitment to build a fueling location. In the next few years that will change, as more competition enters the market, and new technology appears that drives down the investment cost of a fueling station. At some point, the network will no longer wait for demand, and will embrace a “build it and they will come” attitude.

-

Technology: The engine and onboard fuel tank technology now on the market is the first generation that is ready for heavy-duty use. Engine makers and truck builders are now introducing spark-based and compression-based trucks and engines based on mainstream technology. The inflection point for the truck technology is more dependent on fuel storage, not engine. Companies like GE are developing ways to shrink the footprint and the complexity of LNG liquefaction facilities. While it will be a few years before we start to see solutions in a box, it will not be long before these companies develop a compact liquefaction operation that can supply a local network of fueling stations.

As with any other technology or market, as demand grows, so does supply. The cost of the engines, maintenance, and conversion infrastructure will drop, lowering the investment differential between diesel and natural gas. As the investment differential drops, there will come to be a greater return on investment due to the cost differential between natural gas and diesel.

Diesel will remain a primary fuel source for some time. There are applications for which it just does not make financial or operational sense to convert to natural gas. Over time, however, diesel’s share of the motor fuel market will yield to the natural gas alternatives.

Eventually, we will run our fleets on a mixture of dinosaur farts and dinosaur slime.