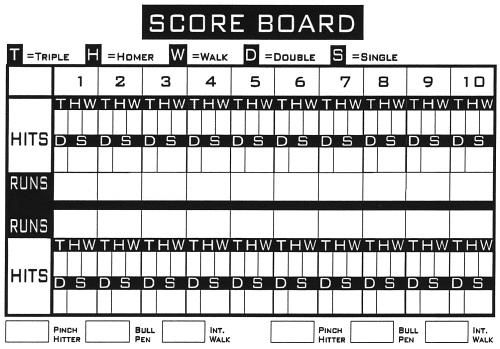

All Sports Have a Scorecard

Numbers. Numbers on a balance sheet or an income statement?

Do you know the difference? Both are filled with numbers. Which one number on which document tells you whether you are winning or losing?

The balance sheet tells you two things: what the business owns (assets), and what the business owes (liabilities). By definition, it must balance the assets and the liabilities.

An asset is something the business owns—that is, things and stuff. Assets are buildings, inventory, receivables, fixtures, computers, cash, and goodwill. Assets are both tangible and intangible.

The income statement tells you what the business took in as revenue and what it paid as expenses. Revenue minus expenses equals profit.

So, is profit the score to pay attention to? Nope. You need to pay attention to the cash. Profit is an opinion, and cash is fact.

Are you confused? Don’t feel bad—many people are. Many companies throughout history have made great profits and still gone out of business. Enron is one example. That was a very public story. They made big profit but negative operating cash. Every year there are companies that show a profit but still go out of business.

The conventional wisdom is that business must be profitable. But being profitable does not mean that a company makes any cash money.

The important measure of any business is how much cash it generates from its operations. That measure does not appear on the balance sheet or the income statement. You must use both documents, and some arithmetic to figure it out.

Do you know how much operating cash your employer created in the last fiscal period? Most people don’t. They may know what the profits of a public company are, but in many family-owned companies, the financials are a family secret. The reasons for this are murky; sometimes it's just paranoia.

There is a natural benefit to transparency of public and private financial performance and alignment. When all the associates are pulling together, a company performs better. Associates are enlisted and engaged when they are given the ability to see financial performance and how they contribute to it. Peter Drucker teaches us in "The Practice of Management" that high-performance business leaders ensure that employees at all levels of the company understand the goals and how each manager contributes to performance.

If you don’t know the score, how do you know how you are doing? If management does not show you the financial results of the company, you are not working for a high-performance business.

One reason company management does not share financial reports is that they sometimes don’t understand them. Even in public companies this is a problem. Sometimes managers are promoted for their tactical and executive achievements, not their business knowledge. They learn some of the fundamentals through on-the-job training, but just enough to get by. Others depend on the technical knowledge of subordinates or superiors, trusting in the appearance of knowledge. That trust can be misplaced.

Understanding the scorecard and vocabulary of business opens the door for improvement in your career. The more you understand the language, the better you understand the impact of your decisions on the business, and the impact others can have on the business. You become more valuable to your employer when you can understand and speak the language. More important, if your current employer does not value that skill, your next one will.