Regulators Will Regulate

March 18, 2013

From the response of the media — like a report from one Chicago news station, and the panic on the websites of various environmental groups — you might get the impression that the US Federal government is turning a blind eye to the unsafe transport of Crude By Rail.

That would be a wrong assumption to make. With federal regulators, it is not a matter of if they start to pay attention, but when.

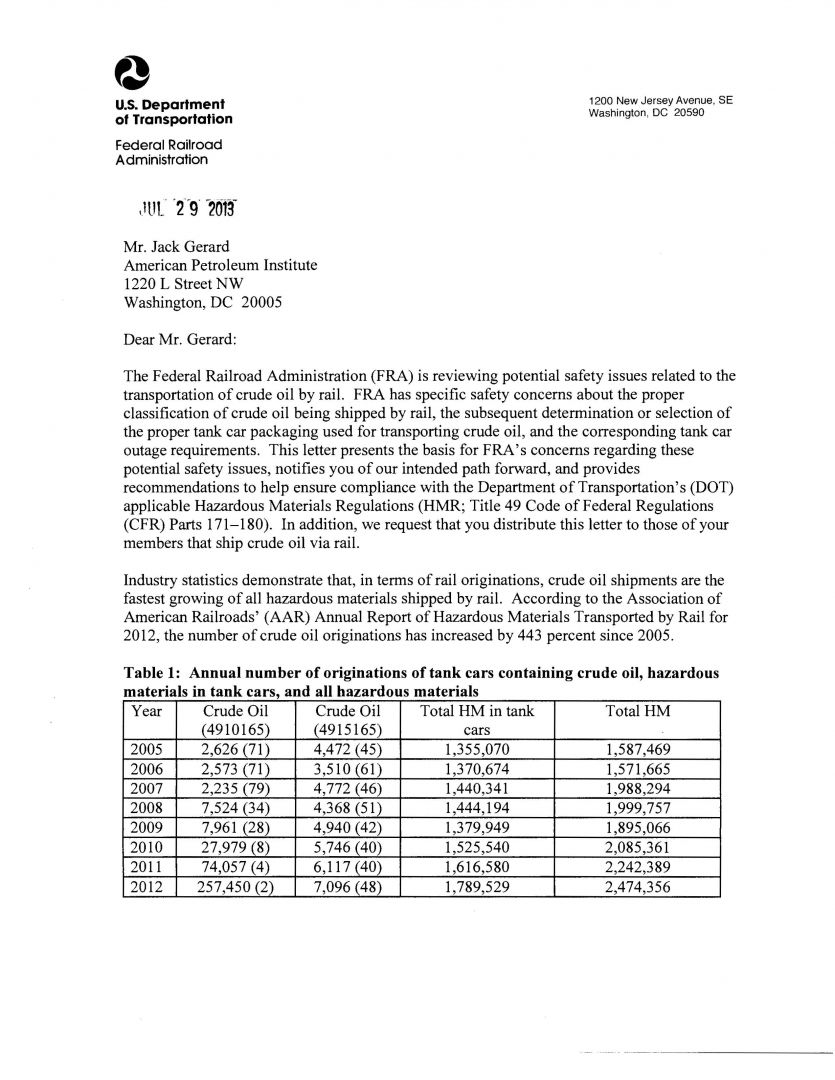

In the case of CBR, they started to pay attention last summer. On July 29, 2013, Thomas Herrmann, Acting Director of the Office of Safety Assurance and Compliance at the Federal Railroad Administration (FRA), wrote a letter to Jack Gerard at the American Petroleum Institute. Herrmann said in his letter that the FRA is “reviewing the potential safety issues related to the transportation of crude oil by rail.”

Before you write off the five-page letter as fluff, consider the following points made in Herrmann’s letter.

- FRA has specific safety concerns about the proper classification of crude shipped by rail and the subsequent determination or selection of the proper tank car packaging used.

- FRA is concerned about proper tank car outage requirements.

- FRA is concerned about the condition and general reliability of the tank car fleet, and the corrosive properties of crude oils.

The letter is an official notification of the path the FRA will take moving forward, providing recommendations to help ensure compliance to the Department Of Transportation’s Hazardous Materials Regulations (HMR) covered by the Title 49 Code of Federal Regulations (CFR), Parts 171-180. Addressed to the American Petroleum Institute (which is the national organization of petroleum producers), it is the first official notice of what the regulators are going to look for then when they regulate.

Federal regulators work a specific pattern, following a prescribed process of notification, observation, and enforcement. This letter, written in July 2013, was the first round of notification. By the end of the year, the FRA had started to levy fines on shippers who failed to follow the regulations.

It Ithoms the Shipper’s Duty

By addressing the letter to the American Petroleum Institute, Herrmann focused the FRA's concern about compliance issues on the source of one of the problems — the shippers loading and selling the oil at the beginning of its long journey to the refinery. Title 49 CFR 171.1 requires that an offeror (shipper) of hazardous materials properly classify and describe those materials. The HMR also prohibits a shipper from offering hazardous materials for transportation unless the tank car meets HMR requirements. In the case of crude oil, the shipper must identify the flash point, corrosiveness, and specific gravity at the loading and reference points. The shipper must also acknowledge the presence of specific compounds.

For many hazardous materials, a shipper can use the MSDS sheet to determine the specific nature of the product and the proper application of the HMR. An MSDS works for manufactured chemicals and materials for which the manufacturer knows and controls the specific content of components and the concentrations. Crude oil presents a unique problem, as it is a natural product (not man-made), so the specific chemical content is different from well to well, and even from place to place within a well. Crude oils blend in the gathering and car-filling process. Because of the blending process, there is little chance that an MSDS sheet will provide the needed material for a shipper to classify and document properly.

This is the first of the FRA's three safety concerns. Herrmann's letter indicates that FRA audits of the classification process for crude-oil loading facilities revealed that terminals relied solely on MSDS data that provided a range of material properties. Investigating further, the FRA says that MSDS data is not gleaned from any recently conducted tests, and that it is based on testing from many different sources. The letter cites an example in which a shipper contracted for an AAR class car and classified the oil as Packing Group III, although the oil actually had a flash point of 68 degrees, indicating that it was the more volatile Packing Group I. This illustrated a misuse of HMR packing exceptions for crude oil, a clear violation of the HMR.

Considering the speed at which audits and regulatory letters move, the FRA had to be looking at the issue before the July 6, 2013 Lac-Mégantic accident. The problem of shippers not classifying their hazardous materials cargo officially became an issue when this letter was sent to the organization to which many of these shippers belong, The Petroleum Institute.

A Surprise?

For crude producers and sellers to claim surprise that the MSDS sheets could be inaccurate for the purpose of classification is laughable. What was a surprise to many, however, was the volatility of Bakken Range Crude.

The Canada's Transportation Safety Board’s report on the oil contained in the undamaged cars involved in the Lac-Mégantic accident marks the first time government officials have reported comprehensive test results on the train's oil. That report, released in the last week of February, 2014, said the oil's flash point (the temperature at which it can ignite) was "similar to that of unleaded gasoline."

A February Wall Street Journal analysis indicated that Bakken oil contains more combustible gases than oil from elsewhere. While crude oil is generally considered hazardous, it isn't usually explosive. According to the Journal's analysis, oil from North Dakota and the Eagle Ford Shale in Texas had Reid Vapor Pressure (RVP) readings above 8 pounds per square inch (PSI), with some Bakken readings as high as 9.7 PSI. For comparison, Louisiana Light Sweet from the Gulf of Mexico averaged a vapor pressure of only 3.33 PSI. The Canadian lab report said vapor pressure of the oil involved in the July 2013 accident was 9.04 to 9.6 PSI. However, those readings may be lower than they were at the time of the accident, since some volatile gases likely escaped during testing.

That makes Bakken oil almost as volatile as gasoline. Gasoline volatility is normally well below 14.7 psi. The U.S. Environmental Protection Agency limits the RVP of reformulated gasoline supplies in areas with poor air quality in summer to 9.0 or even 7.8 psi.

RVP matters because it is a measure of the tendency of crude, gasoline, or other inflammable liquids to evaporate and form an inflammable or explosive cloud. The higher the RVP, the more likely the liquid in the tank car will create vapor and build pressure while in transit. Tank cars have pressure relief valves to release built-up pressure. These releases do not form massive clouds because they are often short in duration and low in volume. If the pressure relief valve stops working, however, the pressure can build to the point at which the car can start leaking material.

In a wreck, the likelihood of a tank puncture is high. Most older DOT-111 cars and AAR class tank cars are built with thinner steel walls — less than half an inch. The older the car, the more likely the corrosive nature of the crude oil it has carried over its lifetime has compromised the thickness of its steel.

This is the reason for the FRA's classification concerns. Once a shipper knows the classification, it is the shipper’s duty to determine the correct type of car for the loading, and to ensure the car’s ability to carry the cargo safely. Without testing, the shipper can’t choose the right car. Failure to choose the correct car is a violation of the HMR, for which the FRA and DOT can fine the shipper.

By the way, the DOT and the FRA started to levy fines last month. Regulators will regulate.