Defending Ron Johnson — Closing Arguments

April 24, 2013

Failure is common. Victory is uncommon. Failure is so common that most people fail to analyze it in detail.

The wide receiver runs the pattern and the quarterback launches the ball to the imaginary intersection of runner and arc of trajectory. The ball falls just inches from the grasp of the receiver. What happened? Did the QB throw the ball too hard? Did the receiver run too slowly? For many people, the cause of failure has to be one single thing, the failure of one person. But there are hundreds of things that can go wrong in that simple pass play; the odds of failure are orders of magnitude higher than the odds of success.

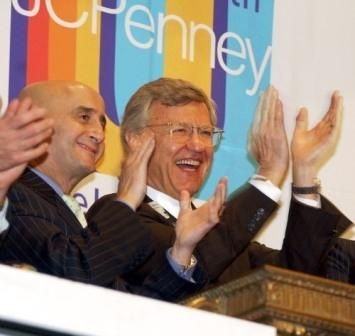

When a business failure as massive as the failure of JC Penney happens, it is easy to lay the blame at the feet of the CEO. In this case, in the court of public opinion, a self-appointed jury of business writers and pundits, the inquisitors of modern media torture, declared that Ron Johnson is a heretic, someone who deserves to be burned at the stake.

I don’t quite get it.

I don’t quite get it.

In my career, I have seen failure up close. I have heard the wails of pain from the people, the scuttling feet of the guilty, the sotto voice whispers of the conspirators; and I have snatched victory from the jaws of defeat. My job is to clean up the carnage, figure out how to get the wheels back on the wagon, and get the show back on the road. While I focus mostly on fixing what went wrong, I also look at how things went wrong, and who had a hand in what went wrong. In every failure, there are people who help, and then there are people who “help.”

The reality of an organizational failure is: when the organization fails, everyone owns a piece of the failure. There are no innocent players. All are guilty, but Ron Johnson has been scapegoated.

Years ago, I took over the operations of another scapegoat manager. He left for me a neatly organized file drawer containing five different major problems. The work he had done in the arrangement of the materials was meticulous, a work of art. This file was like a platter of wonderful looking tea sandwiches, beautifully presented on a silver tray. Despite how good it all looked, when I bit into each sandwich I discovered that it was filled with the foulest tasting s...t you could imagine. In each case, the manager was making the right moves, but somebody supporting the effort had switched the filling, substituting dog poop for the ham and cat poop for the chicken. In each case, one of this manager’s peers or subordinates, or the boss, had made the switch. It was a stunning story of betrayal. It cemented in my mind the following rule: in an organizational failure, there are no innocent parties.

A Dizzying, Twenty-One-Course Meal — JC Penney

Looking at the situation objectively, looking at all the evidence, I can’t convict. Johnson is not the only one who had a major hand in this mess. There are so many hands in this horrible, 21-course banquet of crap. The meal is not over. Hell, we may only have reached the intermezzo, since we’ve just finished the messed-up pasta course of Mr. Johnson’s efforts. As of this writing, we don’t know how long Mike Ullman is going to sit, so he may be the cooling taste of a quick sorbet before we get to a heavy course of whoever will take the role of the poached quail.

If JC Penney has just now reached the intermezzo, the tenth course of the 21, then the next course is sure to be critical. Typically the eleventh course is a small game bird, and roasted or poached quail can be tough to cook and serve right. It is a little bird, very easy to overcook, and just as easy to undercook. Done right and kept simple, it is the first major course of a great meal. Get the quail wrong, and the meal goes downhill. Just as much as the eleventh course is critical to the rest of the meal, so is the next phase of what happens at JCP, where management has to undo the damage done in the first nine courses.

The task of undoing the damage will be more complex than just ripping out what Ron Johnson did. Much of what the Johnson regime removed needed to go, and a great deal of what Johnson brought in needs to stay. The times are changing. People who argue that the culture of the customer does not change are in denial. Polyester Penney’s must change in order to survive. While it is easy to think that Johnson damaged Penney, he did less damage than was done before his arrival. His timing merely sucked.

Don’t believe me? Let’s review the first nine courses of crap that is the JC Penney meal. The first two courses are some older history, but any large meal deserves two amuse courses to set the right mood. You’ll see that modern “Polyester Penney’s” was never far from retail failure.

First Amuse – Preamble to Disaster - Averted

JC Penney moves its headquarters from bustling New York City to sleepy Plano, Texas. James Cash Penney originally moved the headquarters of the company from Salt Lake City, Utah to New York City in 1914 to be close to supply markets. The 1990 home office move to Plano lowered the cost of operations for the headquarters, but it also swapped out a great deal of the buying and merchandising DNA of the company. Still, the lower S & GA expenses cleared the palate for rapid future growth.

With a pile of cash and a growing equity market, Penney expanded with the purchase of Fay Drug, Kerr Drug, and then Eckerd Drug in the mid 1990s. Sears exited the catalogue business, leaving JCP as the last major player in that field. That turned into an opportunity to become one of the first major Internet players. Due to reported management infighting, poor merchandise, and a sour economy, by the mid-1990s, Penney was suffering major cash-flow problems. If not for the strength of the Eckerd operations, the floundering department stores would have sunk the company. To raise money, Penney sold its credit card operations to GE Capital in 1999 for $4 billion. Working to make top line improvements, the company started to test a “stores-within-a-store” concept to highlight the JCP private label brands of Arizona Jeans, St. Johns Bay, and Worthington (although the press would have you believe that the “store within a store” concept was Ron Johnson’s failed idea). Then CEO James Oesterreicher launched a $488 million restructuring plan in in March 2000, only to throw in the towel in the middle of the work and announce his early retirement.

In September 2000, the Penney board hired Allen Questrom as CEO to help rescue the company from the brink of bankruptcy. Questrom had a track record for turnarounds, having brought Federated Department Stores back from the dead in the early 1990s, in the process guiding the Federated takeover of Macy’s and The Broadway department stores. Hired with a mandate to work his magic and return Penney to solid profitability, Questrom started working with former Wal-Mart executive Vanessa Castagna to turn the store operations around. As chief operating officer, Castagna conceived the “It’s All Inside” slogan, and a centralized merchandising program that brought uniformity to the operations.

Questrom continued to cut away at waste and underperforming operations, selling non-store operations and fighting a corporate culture that resisted change. Questrom restructured the company into a holding company, ultimately to facilitate the spinoff of the Eckerd drug chain, which itself was in trouble and in need of a turnaround. In July 2004, JCP collected about $4.7 billion in cash with the sale of Eckerd to CVS and Rite-Aid. With that infusion of cash, a reduction of debt, and improved revenue and lowered costs in the department stores, JC Penney began to rebound.

Questrom continued to cut away at waste and underperforming operations, selling non-store operations and fighting a corporate culture that resisted change. Questrom restructured the company into a holding company, ultimately to facilitate the spinoff of the Eckerd drug chain, which itself was in trouble and in need of a turnaround. In July 2004, JCP collected about $4.7 billion in cash with the sale of Eckerd to CVS and Rite-Aid. With that infusion of cash, a reduction of debt, and improved revenue and lowered costs in the department stores, JC Penney began to rebound.

Second Amuse – After the Turn

In December 2004, Myron (Mike) Ullman took over the leadership reins in Plano. Ullman targeted middle-income women 35 – 54 years old, whom he saw as a new, underserved demographic. Developing new brands for this new demographic, Ullman pushed an image-based marketing plan that advertised JC Penney as a place for people to shop for more than just sales, eschewing the promotion-based approach Questrom and Castagna had used. Layering in an Internet-based POS system that tightly integrated with the newly branded JCP.com helped push Internet revenues past $1 billion.

No longer in turnaround mode, Ullman’s management team launched a long-range growth plan, opening new stores, including off-mall properties that proved to generate higher sales per square foot than the mall-based units. Ullman pressed for the introductions of new private label and exclusive-to-JC Penney brands, expanding the store-within-a-store concept to include Sephora cosmetics, picking up the exclusive rights to the Liz Claiborne brands, the Ambrielle lingerie brand, and over two dozen other brands. In an effort to improve the chain’s image, the company changed its slogan to “Every Day Matters” in 2007. It would not be long before the new slogan became very true for the company.

Caviar – Irrational Exuberance

As the economy grew, so did management’s dreams of wealth for the company. With aggressive expansion plans, new merchandise brands, and strong marketing, Ullman and team set a series of aggressive financial goals. Projecting 8% compounded growth from 2007 through 2011, Ullman’s team projected total revenue approaching $30 billion, with a profit margin that outpaced Macy’s. With an operating income of 9.7% of revenues in 2006, management projected a growth curve delivering 15% by 2011, equaling Nordstrom’s. And why not— EPS had grown from 58 cents in 2001 to $4.88 in 2006. While the housing-bubble-induced credit crisis loomed on the horizon, things looked grand to Ullman and company.

We all know what happened next. The bottom dropped out of the global economy. The ATMs disguised as houses quit coughing up money, and people quit buying the stuff that JC Penney sold. Remember Mike Ullman’s chosen target market? Middle-income women 35 to 54 years old. What did they have to spend? In most cases, they were working hard to keep food on the table, shoes on their kids’ feet, and clothes on their growing bodies. These women started to cut back on spending, big time. Who did have spending money? The kids of those 35 – 54 year old middle-income women — kids who did not want to be caught dead in a JCP store. Who else had money? The people who shopped Nordstrom, Saks, and Bloomingdales. And the middle-income women had more choices, like the rapidly expanded Kohl’s, and its name brands.

With a massive hole blown in the financial plans of the Good Ship JCP, Mike Ullman had to get promotional in order to keep the demographic on which he’d staked the future of the company. The brands and the marketing had not generated the expected stellar gross profits, and the only way to move the merchandise was an ever-increasing array of promotions and coupon programs. Once this path was taken, the other demographics that could have brought more revenue into the company forgot about JC Penney, since those demographics did not read newspapers (where the coupons appeared), and had dozens of other options that presented fun and value.

Hooked on a single demographic that only responded to promotions, unable to develop either a marking message or products that appealed to the demographics with more flexible discretionary income, like the 18 – 34 age groups, Ullman and team continued down the promotional path, chasing the illusion of heavy discounts and paper coupons to attract middle-income women. Others likened their tactical plans to an addiction.

Polyester Penney’s returned, once more.

Shellfish – Stock Buyback

The large institutional investors who make bets on growth can be an impatient lot. These mutual funds and retirement plans wield a tremendous power, and can place pressure on the board and management of a public company. While some of the institution bought in in the early days of the Questrom turnaround, many bought into Penney when they heard of the mighty growth plans developed by management in 2006. Those funds and institutional investors, the ones that bought when the stock was a value investment, slowly exited their positions, as others, excited by the growth plans, bought up the stock. Imagine everyone’s surprise as performance stumbled in 2007, and the massive price drops reflected what happened.

In late 2010 and early 2011, the management team convinced the Board of Directors that an open market buyback of stock was the best use of over $800 million of cash. Buying back the stock would increase shareholder value and lower the quarterly dividend payout. Not that share buybacks ever really help out all stockholders, but they do help out the special institutional holders, like pension funds (read CALPERS) that bought the stock when it was trading in the low teens. At the end of May 2011, the company bought over 24 million shares for just under $900 million in cash — about $36 per share. That is a nice return on investment for the institutions.

This shell game of wealth also put restricted stock units (RSU) into the money, because a reduction in shares meant that the earnings per share increased. The EPS increased enough that if there was a change in management, the RSUs would be in the money, and a management change would trigger instant vesting of the units. Under the guise of improving shareholder value, the management team ensured their own shareholder value. If they really had wanted to improve shareholder value, they could have increased the dividend.

Cold Appetizer - Voluntary Early Retirement Program

In August 2011 the company announced the implementation of a voluntary early-retirement program (VERP) for specific groups of eligible associates. Any active pension-plan participants in any position other than store manager at least 55 years of age, with over 20 years of service, could participate in the VERP. Approximately 4,000 of the 8,400 eligible associates accepted the plan, and the company took a one-time charge of $179 million for the enhanced retirement benefits, including curtailment charges and the costs of administering the VERP. Exempting the store managers, most of the people who accepted the VERP were the middle managers and administration people who kept the corporate wheels turning, like distribution, inventory replenishment, and assortment planning. Once they accepted, these people knew they would be gone in under 12 months.

Thick Soup – Why Rent When You Can Own?

In November, 2011, the company completed its acquisition of the worldwide rights for the Liz Claiborne and Monet clothing brands, for which it paid $268 million. The company already held the exclusive rights to those brands for a limited period of time, and would have kept the rights for a few more years, but somehow management thought it would be better to own the brands than rent them.

Thin Soup – Martha, Martha, Martha

On December 6, 2011, JC Penney purchased 11 million shares of Class A common of Martha Stewart Living Omnimedia, Inc. (MSLO) for $38.5 million. Concurrently, Penney entered into a long-term commercial agreement with MSLO to create an in-store and online retail experience featuring Martha Stewart products. This happened while MSLO maintained a commercial agreement with Macy’s, an agreement that had started in 2007. If JCP taking an ownership position in one of its exclusive suppliers was not enough to make Macy’s management nervous, having that supplier start to sell to a competitor pissed them off, and a miffed Macy’s filed injunctions against the deal, tying up over $100 million of Martha Stewart branded merchandise in JC Penney warehouses.

Antipasto – Hedge Fund Fun

This is where things get interesting. For some reason, it appears that large fund managers think they can manage retail companies. These guys, who play the equity and bond markets with amounts of money that dwarf the revenue of most of the companies they invest in, think they can unlock value in a retailer like they can in a manufacturer.

There is a problem with this theory. Retail companies are not like manufacturers. The theory runs into the wall of reality every time a hedge fund manager buys into a retailer. It’s not that they fail all the time; it’s that they just don’t ever create the knock-it-out-of-the-park successes they promise. There are many examples of underwhelming performance, and some spectacular examples of utter failure. Heck, I could write a whole series of articles on just the failures.

Smelling a bargain, activist fund Pershing Square Capital Management, led by William Ackman, started to buy the distressed shares of JCP. Just like the customers who actually shopped in the store, Ackman started to buy the shares in 2010 as the stock bottomed at $20 per share. Slowly buying more, never paying more than $28, Pershing held about 16% of the open shares by the end of 2010, making another buy when the stock pulled back in the middle of 2011. With 16 – 1/2% of the stock before the buyback, and something north of 24% after, Ackman became the largest investor in the company, commanding board representation — and a rather loud voice in boardroom decisions.

One of the decisions: bring aboard a new CEO and management team to transform Polyester Penney’s into America’s Favorite Store.

Pasta — Johnson

There are many stories about what happened next. How true any of those stories are I will leave to the reader to judge. This tangled pasta course proved to be more involved than most people expected. The absence of enough competent middle management to press through the change ensured the internal failure of the pricing and stocking changes. As the smart people with the past turnaround experience left in the VERP, internal resistance built as new and less experienced managers took over.

While many have commented on the apparent stupidity of shunning the core customer by removing the promotional drug of coupons and markdown sales before replacing them with the new demographics, Johnson did not have the CAPITAL or TIME to create a new customer base and stem the flow of losses from the promotional programs. The $900 million of cash the previous regime spent on stock buybacks, and the $268 million buying brands JCP already controlled, eliminated the financial power that Johnson could have used to attract new customers.

Much has been made about what the company spent in signing bonuses to bring on the new team. Those millions are the kind of financial enticement necessary to attract risk takers to play in the danger zone of a turnaround. What Johnson took over was a turnaround, just as much as when the JCP board hired Allen Questrom. The bonuses and the expenses were a small drop in the bucket compared with the cash wasted in the last years of Ullman’s first tenure.

Without the experienced human capital needed to make the operations work, and without the financial capital needed to weather the storm of reduced revenues, Johnson and company took to the ring, not understanding that they held the ropes that would hold their arms behind their backs.

Remember, in any organizational failure, there are no innocent parties.

The defense rests.