Natural Gas Trains

Railroads are the home of high horsepower diesel power. Pulling 100+ car trains of coal, oil, or freight requires horsepower measured in the thousands, sometimes tens of thousands. That horsepower requires fuel — lots of fuel. US Class 1 railroads consumed 3.7 billion gallons of diesel in 2011, and almost the same in 2012. That is about $9 billion in fuel costs. Behind labor and debit service, fuel is the largest line item expense for many of the Class 1 railroads, which highlights the importance of improving fuel efficiency.

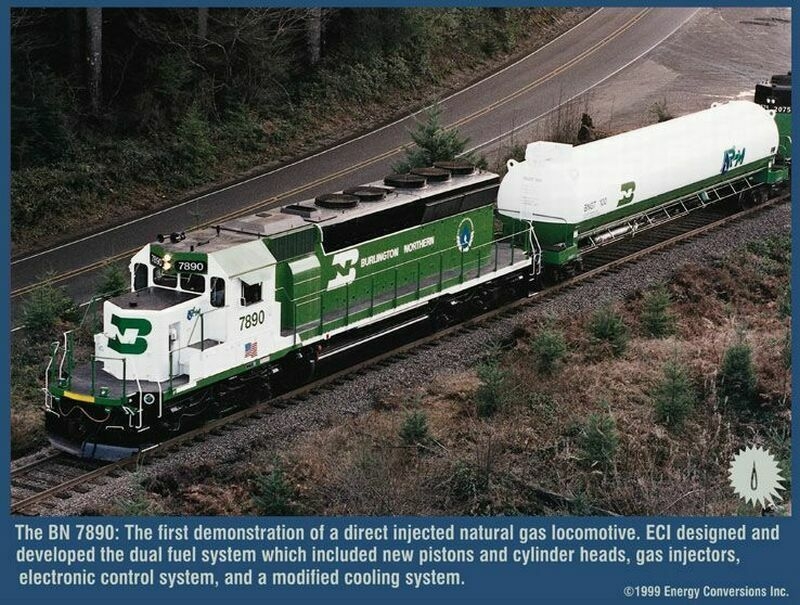

American railroads started looking at LNG as a fuel in the 1980s and '90s. Burlington Northern worked with Energy Conversion, Inc. from 1988 to 1996 with a pair of converted EMD SD-40-2 locomotives and two fuel tenders. The locomotives worked in Powder River Basin coal service from 1991 until 1996. Union Pacific sponsored development and testing of locomotives by both GE and EMD between 1992 and 1998, but the program locomotives never saw service on the UP. The BNSF continues to use four switch locomotives built by Morrison-Kundsen, powered by 1,200 HP Caterpillar spark ignition engines.

Canadian National (CN) started a LNG demonstration program in 2012, fielding two EMD SD40-2 locomotives. Using conversion kits, the compression-ignited 3,000 horsepower engines entered testing service with a 30,000 gallon LNG tender on loan from BNSF, the same tender that the old BN used for their testing in the 1980s. Westport energy is developing a new tender based on the a standard 40' ISO LNG storage and transport tank mounted to a flatcar, with the equipment needed to vaporize the LNG for transfer to the locomotives.

Canadian National (CN) started a LNG demonstration program in 2012, fielding two EMD SD40-2 locomotives. Using conversion kits, the compression-ignited 3,000 horsepower engines entered testing service with a 30,000 gallon LNG tender on loan from BNSF, the same tender that the old BN used for their testing in the 1980s. Westport energy is developing a new tender based on the a standard 40' ISO LNG storage and transport tank mounted to a flatcar, with the equipment needed to vaporize the LNG for transfer to the locomotives.

Capital Intensive

Railroad managers are a cautious group. This culture, which has historical roots in a regulation-heavy past, looks at changes in infrastructure with an eye for the long term. While diesel locomotives appeared in the 1930s for extensive testing, it was not until the 1950s that diesel locomotives outnumbered steam-powered locomotives. With an asset life of over 20 years, a locomotive is a long-term capital investment. With a price tag of over $2 million, the investment cost of a locomotive is as large as the locomotive itself.

The capital commitment does not stop with the locomotive. Changing locomotives requires changes in supporting infrastructure, like fueling depots and maintenance facilities. While trucks face the same challenges, railroads scale up the size of the system components five- or tenfold. Where a truck may carry 300 gallons of diesel, a locomotive carries more than 3,000 gallons to feed hungry 16-cylinder engines. It takes 5,700 gallons of LNG to equal 3,000 gallons of diesel, so the fueling operations must move more volume faster. That requires industrial-scale fueling, storage, and delivery. Seven thousand gallons is more than a locomotive can carry in its fuel tanks, so LNG trains need a rolling LNG tank to haul the long distances.

Although the size of the fuel systems and the costs of locomotive conversions for railroads are staggering, over 24,000 locomotives are available to convert. Even with new builds, the conversion process will take years, depending on financial resources and market incentives.

Fuel Tenders

Fuel tenders are important to the process. As with the complexity and associated cost of the LNG fuel tanks in trucks, the railroads must develop fuel tanks of sufficient size to provide long-distance service between refueling stops. Tenders are not new; steam locomotives towed a special-purpose car that carried the fuel and water the boiler consumed to make steam. While coal and water are safe, LNG provides its own challenges, increasing safety risk.

In the last round of testing, the railroads and the locomotive suppliers developed LNG tenders similar to rail tank cars. Both BN and UP developed 25,000+ gallon tenders from heavy-duty tank cars, mounting the supporting equipment under the tank and on the ends of the cars.

Railroads are obsessed with safety. The Federal Railroad Administration (FRA) assesses railroad equipment — like locomotives — for safety in order to protect the railroad employees and the public. Through the industry trade association, the Association of American Railroads, key players in the rail industry started to develop an industry standard tender as the AAR Natural Gas Fuel Tender Technical Advisory Group (TAG). The TAG is addressing both design and regulatory safety issues, like FEMA rules that do not allow movement of LNG via rail without a waiver from the FRA. Through design work with locomotive builders and railroad operations, the TAG identified and submitted to regulators over 100 failure modes that the design must address.

The TAG is considering two different designs; one based on the tank car prototypes of past testing, the other using the concept of 40' ISO LNG containers on flat cars. As a 40' ISO container, one design looks at using a modified deep-well intermodal car to allow a double stack of the ISO tanks, providing a 20,000 gallon supply. By using the ISO tanks as removable storage, refueling of a train set can be as simple as lifting off the empty tanks and replacing them with tanks filled at an off-site location.

At 400 gallons per minute, refueling a 25,000-gallon tank car takes 30 to 40 minutes. While that's longer than a diesel stop, that 25,000 gallons allows a locomotive set to move from Los Angeles to Chicago without refueling, so while the LNG refueling stop takes longer, the one-time refuel offsets that extra time by eliminating the multiple diesel refills a diesel locomotive would need to make the same trip. The 25,000-gallon tanks require dedicated refueling systems with the volume of flow to support 25,000-gallon fill-ups. The refueling facility must have as much as 200,000 gallons of storage to support multiple refills in a day. With sufficient volume, a railroad LNG refueling depot may one day be able to support one of the mini LNG liquefaction stations like the ones that GE and others are marketing today. That will require the construction of high capacity and pressure distribution lines to carry the gas from the interstate transmission pipelines to the railroad depot location. Liquefaction requires electrical energy, which the same gas pipeline could supply through an on-site NG powered electrical generation pack. The significant investment in the infrastructure is large enough to slow the growth of rail use.

Testing, Testing, and More Testing

Just as the railroads put diesel power through significant testing demonstrations from the 1930s to the 1950s, the railroads are testing LNG systems now. The latest testing of LNG by CN and the effort by the AAR to develop tender standards are the first steps in a long-term program. We should expect a long testing and approval process to address safety concerns.

The effort is not so far underway to make the claim that it is a matter of when, not if, LNG replaces diesel in railroad locomotives. However, with the uncertainty of future oil prices, the railroads now see economic benefit in examining LNG options. What remains is to develop solutions to the technical and regulatory obstacles. When the details define the final investment requirements, an economic justification may remain.

Articles in This Series

The first minute of this trainspotting video shows Florida East Coast locomotives pulling a freight train into Hialeah Yard.

In this video, BNSF CEO Matt Rose talks about the new LNG testing program the railroad launched in 2013.